Explore our dossier on health insurance in Mauritius

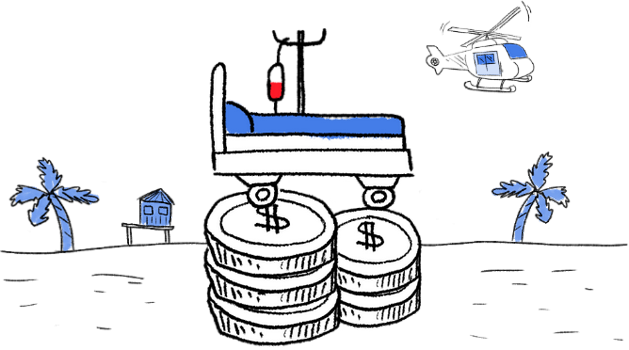

The healthcare system in Mauritius is based on the English model, and has the same advantages: free access to healthcare for Mauritian citizens and residents. But it also has the same shortcomings: too much demand vs. a lack of resources, accentuated by the difference in living standards. The best care and specialists are found in the private sector, where you will have to pay all the bills out of pocket. With expatriate health insurance in Mauritius, you can avoid financial trouble and benefit from coverage if you ever need repatriation to Reunion Island, Europe, or South Africa.

| Healthcare expenditure per capita and per year | €758,49 |

| Annual indexation of health expenses | Indisponible |

| Hospitalization reimbursement rate w/ the Fund for French Abroad (CFE) | 67% à 100% |

| Number of insurance companies available | 15 |

| Annual cost of hospitalization coverage for a 30-year-old | €696 |

| Annual cost of hospitalization coverage for a 50-year-old | €1 188 |

The Mauritian government has set up a project to improve the healthcare sector by 2030: the National Health Sector Strategic Plan (HSSP), with a five-year deadline to achieve its initial goals. Similar projects have fueled progress in the Mauritian healthcare sector over the past few decades, leading to an increase in life expectancy and reduction in infant and child mortality.

The country's current healthcare challenges are: increasing demand for quality healthcare and access to a wider variety of specializations, an aging population, which leads to a natural increase in healthcare needs, and the demand for treatment of long-term diseases such as diabetes and hypertension (which particularly afflict the country). Currently, three new health centers are under development – the New Cancer Hospital, the New Eye Hospital, and the New Training Centre (at the Flacq Hospital, funded by the Dubai Fund) – as well as a project to digitize health records (e-health).

The Minister of Health agrees that there is a legitimate need for universal health coverage for Mauritian residents. The HSSP aims to meet this demand, in line with WHO recommendations and sustainable development objectives. The European Union contributed 380 million Rs to help the country upgrade medical equipment and train personnel.

The general sanitary situation is good, with no particular epidemiological risk. Malaria is absent from the island. Dengue fever or chikungunya may be present from time to time (via importation of the virus).

The consumption of tap water is not recommended because, even if it has been treated at the source, the quality of the water can be degraded by a faulty distribution network (or very chlorinated).

No special precautions are required before departure. There are no mandatory vaccinations, but the following are recommended: Hepatitis A and B, DTP (Diphtheria, Tetanus and Polio), Pertussis (Whooping Cough) and Measles, and Typhoid.

However, we advise you to have a general and dental check-up a few weeks before leaving so that there is time to undergo any necessary procedures before you go.

Public hospitals and clinics are accessible free of charge for all Mauritian residents. However, be prepared to have some time to spare if you are eligible, as waiting times are long, especially due to the lack of personnel (only 4,000 nurses in 2019).

On average, a general practitioner consultation costs from 500 to 600 Rs, and from 600 to 900 Rs if the physician makes a house call. While a specialist consultation costs 800–900 Rs, and up to 1,200 Rs for a house call.

Rates are established in the private sector by the association of clinics, which coordinates the cost of operations, but the final bill will vary greatly by any additional services used (private rooms, meals, etc.).

In the case of hospitalization, the room rate can range from 3,500 to 11,000 Rs depending on the services offered (meals, etc.). The costs of surgical procedures depend on their "class": minor, intermediate, major, or major plus. A wisdom tooth extraction would be an "intermediate" procedure, with rates ranging from 10,000 to 19,000 Rs. A cataract operation would be a "major" operation with a price range of 25,000 to 50,000 Rs. Finally, a prosthesis would be a "major plus" procedure, costing 70,000 Rs or more.

When it comes to examinations, an angiography will cost around 20,000 Rs at the Mascareignes Cardiological Center, for example, while a scan will cost around 3,500 to 4,500 Rs.

Physicians' fees while hospitalized vary between 2,325 and 3,487 Rs, and are determined by the number of days of hospitalization, the pathology being treated, and the number of visits needed. Note that consultations cost 20% more after 5 pm and on Sundays and holidays.

It seems that the practice of "over-examination" is common in Mauritius. Private clinics understand that performing more tests allows them to increase the bill, which can then be paid by insurance. As a consequence, local insurance rates have increased to match the increase in claims – so patients end up paying for this over-examination.

Dental expenses are quite cheap. For example, DentCare (Labourdonnais dental clinic) provides quality dental care – up to international standards, but for 25% cheaper than in France. If you have regular dental issues, however, dental coverage may be worthwhile.

Concerning maternity, a natural childbirth costs between 45,000 and 60,000 Rs, while a Cesarean section will cost between 65,000 and 100,000 Rs (all inclusive). An ultrasound costs from 1,500 to 2,500 Rs on average.

Note that the WHO has denounced Mauritius for its high rate of cesarean sections. While the benchmark is that 10% to 15% of deliveries should be cesarean sections, in 2019 C-sections accounted for 56.4% of births in Mauritius (62.1% in the private sector, and 53.9% in the public sector).

The WHO estimates that 75% of C-sections performed are unnecessary. This happens due to the youth and inexperience with vaginal deliveries of some practitioners, and also due to insurance policies that fully reimburse cesarean sections but not natural deliveries.

In a country with moderate health costs, expatriate health insurance will primarily cover your hospitalization expenses. Knowing that hospitals may require full payment of medical expenses before patients are discharged, an expat health insurance plan will ensure that, when you stay more than 24 hours in the hospital, your expenses will be covered directly by your insurer.

There are five regional public hospitals in Mauritius – including the Sir Seewoosagur Ramgoolam in Pamplemousses, the Victoria Hospital in Candos, and the City Clinic in Port Louis – which treat all types of illnesses and injuries. And each community has its own clinic.

The public system is severely lacking in resources and the quality of service is low, despite the presence of well-trained professionals (most of them trained in Europe). Treatment is often subject to waiting lists.

In the case of hospitalization, there are no private rooms available, but dormitories of 10 to 20 beds. Along with the waiting times, these are two of the reasons why private facilities are in great demand, in addition to the greater availability of specialists.

The private sector offers a very satisfactory quality of care, up to European standards in most facilities.

Local physicians are trained in Great Britain, France, South Africa, or Russia. There are also many Indian physicians.

Since the beginning of the 2010s, the government has been trying to develop medical tourism and has encouraged the creation of high-level establishments, but this tends to benefit mainly the cosmetic surgery sector.

Several clinics specialize in Botox injections, liposuction, breast implants, hair transplants, or dental care.

Note: Health insurance companies do not cover cosmetic surgery.

In Mauritius, there is a significant lack of specialists in the public sector, especially in the fields of gynecology and anesthesiology – and almost none are available at night.

For example, there are only seven endocrinologists, four gastroenterologists, nine cardiac surgeons, and no pediatric surgeons in the public hospitals (according to the Medical Council).

There are lists of trusted physicians, hospitals, and clinics for expatriates. They are available from embassies or consulates and on specialized websites and groups for expats. These will generally be private physicians and establishments. An expatriate health insurance policy will be your most valuable partner in covering your healthcare costs here.

In the case of hospitalization, the Darné clinic in Floréal has an agreement with the CFE. Since January 1, 2020, the latter has developed a 100% hospitalization coverage partnership with MSH in Mauritius (see our CFE section below). The list of approved establishments will be provided when you sign up.

Otherwise, you have the choice between the various private clinics that offer quality services. Expatriate insurers will all offer direct payment in case of hospitalization, whether you choose a supplementary insurance in addition to the CFE or “at the 1st Euro” (without CFE coverage).

Almost all of them also offer access to a teleconsultation platform for basic health issues as well as a second medical opinion service.

For complex interventions, repatriation to Reunion Island or South Africa (or to France) is possible. To avoid any unpleasant surprises, verify the coverage area of your contract with your adviser.

The Mauritian Ministry of Health has not signed any bilateral social-welfare agreements. Coverage in your country of origin therefore won’t give you any local rights when you settle here.

Your country of origin may in some cases cover tourists, but generally for short stays (within the limit of 90 consecutive days), and within the framework of an unexpected illness – and the limit of their reimbursement caps.

It will not cover temporary or permanent residents in Mauritius. Living here without health insurance can be an expensive experience.

WARNING: Many European retirees spend a large part of the year in Mauritius without notifying their home social-welfare provider under the pretext that they keep a residence in their country of origin. This is a mistake! Social-welfare coverage from your country of origin generally won’t cover your expenses abroad, or will only cover healthcare expenses abroad if they occur unexpectedly during a temporary stay. It may therefore refuse to pay for hospitalization related to an already existing pathology, or ask for proof of a temporary stay, such as airline tickets.

Based on the British model, the Mauritian healthcare system provides free access to public healthcare for all citizens and residents, but no reimbursement in the private sector.

A "Mauritian resident" is any person who has their principal place of residence in Mauritius, or who has resided for some years in Mauritius for at least 183 days of the year, or 270 days in the current year and the two preceding years.

The "local social welfare" does not directly manage healthcare; it takes care of old age and disability pensions, elderly and severely disabled persons, single mothers, offers social assistance and other specific benefits (such as rice and flour allowances, wheelchairs, etc.).

The State finances healthcare largely through taxes, and with the help of private or European funds and financing.

An expatriate health insurance will be necessary to cover medical expenses in the private sector, as well as gaps in the remaining expenses in the public sector.

Signing up for the CFE or private insurance is essential to gaining access to private healthcare. CFE health insurance is available to all EU citizens, not just French citizens. It reimburses all your expenses: medical, surgical, hospital, dental, vision, lab tests, and more – within the limit of the rates and tariffs applied in the CFE’s “zone 1” coverage.

The CFE will therefore cover your expenses incurred in Mauritius, as a first level of reimbursement. For example, they will reimburse 65% of your pharmacy bills, or 50% of your blood tests.

A special feature of the CFE coverage in Mauritius is that 100% hospitalization coverage has been set up for policyholders who have not taken out supplementary insurance. This coverage is provided through MSH, CFE's partner for the up-front payment of hospitalization expenses. To benefit from this 100% coverage, you must first contact the assistance provider and go to the hospital designated by them. You do not have a choice of where to go for treatment.

It is up to you to determine what your needs are and whether you opt for CFE coverage alone or with complementary coverage (or a private policy with full coverage). Having expatriate health insurance in addition to the CFE provides you with 100% hospitalization coverage in the hospital of your choice, and additional reimbursements for your routine expenses – especially interesting for those who want good vision and dental care coverage.

Calculated according to your age and marital status (whether you are looking for insurance for an individual or couple), your contributions to the CFE allow members to be covered in France and abroad, and to quickly recover health insurance rights when you return to your home country.

Among the 23 insurance companies in Mauritius, six of them offer health insurance. Mauritians are increasingly aware of the importance of insuring themselves to cover their healthcare costs, particularly in the event of long-term illness. Insurers thus saw a 12% increase in new contracts in 2018 vs. 2017. And it is estimated that healthcare expenses more than doubled between 2008 and 2017 (+131.9%).

Local health insurers are the Swan Insurance Corporation or Jubilee Insurance, for example. In general, they apply a waiting period of at least three months for their primary hospitalization and routine medical benefits. It’s common to have much longer waiting periods for other conditions (up to 24 months for thyroid conditions, back conditions, cancer, diabetes, etc.). Different coverage caps are available. Be careful to select the one that best suits your needs; they are sometimes very low.

A patient told us that she thought she was safe with a plan of 12,000 Rs per year for her medical expenses, and that she was surprised to see that this reimbursement was exceeded in a single event. The private clinic that she had consulted had performed 130,000 Rs worth of examinations and consultations, and the patient found herself with a large amount left to pay, as well as the unpleasant surprise of seeing her premium reassessed by the insurance company at the next deadline.

Mauritius Union, for example, offers a plan with limits of 10,000 Rs to 25,000 Rs for out-patient physician expenses, and limits of 25,000 Rs to 125,000 Rs for hospitalization expenses, with an annual limit of 3,000,000 Rs. Expat health insurance companies offer higher maximum limits, corresponding to private sector pricing practices, with no risk of out-of-pocket expenses in case of hospitalization (excluding private room services).

In Mauritius, individuals are taxed on the basis of 15% of their total income, as long as they are recognized as residents. The tax is applied to salaries, retirement pensions, rental income, company dividends, etc. This tax is used by the government to finance part of the public health system.

However, several expenses can be deducted from your annual income: the exemption threshold is calculated according to the number of dependents (single: category A, a couple or single-parent household: category B, etc.) and declared expenses related to children's education, healthcare insurance or contributions to a provident fund, costs of domestic employees, solar energy, and interest on real-estate loans.

Employees must provide an Employee Declaration Form (EDF) to their employer with all the deductions to be taken into account. Employers are responsible for the PAYE (Pay As You Earn) portion. They deduct 1/3 of these expenses from the salary, and then apply a contribution rate of 10% to 15% depending on the remaining income. Salaries of 50,000 Rs and below are subject to 10%, and those above 50,000 Rs to 15%. People earning less than 23,461 Rs are not required to contribute.

For more details, please contact the local authorities. You can also consult this website: https://www.mra.mu/

The Mauritian healthcare system allows for free care in the public sector.

However, this health insurance is not adapted to cover the costs of care in the private sector.

Expat health insurance in Mauritius will provide you with the following benefits:

You will also be assisted with all your legal and medical formalities.

Given the prices in Mauritius, a basic or basic-plus level of coverage is sufficient to be properly reimbursed in most cases.

Hospitalization insurance is an essential minimum, but reimbursement for routine care is also useful if you use private facilities.

Dental costs are affordable, but not much cheaper than in most OECD countries. If you have regular needs in this area, dental coverage will be appreciated.

The insurance can be extended to include additional coverage, depending on your situation: repatriation assistance, legal assistance, daily indemnity, death and disability benefits, etc. – all of which can be very useful.

If an important intervention is needed, repatriation assistance will allow for medical evacuation to Reunion Island, a French territory with significant medical facilities and located less than an hour's flight away, or to South Africa or your country of origin.

Ask our team for advice.

With expatriate health insurance, if you are hospitalized for more than 24 hours, the insurer will arrange for direct payment to the hospital/clinic. Routine medical and vision/dental expenses must be paid up front.

Requests for reimbursement are easily done online (no more snail mail): the insurers all offer web-based client platforms, and sometimes mobile applications, for the management of your reimbursements.

In general, invoices of up to €1,000 can be submitted digitally. Invoices over €1,000 (rarer) will still need to be sent by mail.

Signing up for expatriate coverage is more complex than for a traditional health insurance plan. It is therefore advisable to apply about 30 days before your departure or desired date of effect. It’s possible to apply for expat health insurance in Mauritius. However, we advise you to do so before leaving to benefit from the coverage upon your arrival and from an optimal choice of plans. In addition, you will avoid administrative waiting periods.

Our website will help you request a quote online and compare coverage. An adviser can then help you with the entire sign-up process.

Local healthcare offer does not offer for the treatment of all conditions; a medical evacuation may be necessary, either to Reunion Island, South Africa, or to your country of origin, depending on the case.

Repatriation assistance is thus necessary. It also allows you to benefit from additional services, such as bringing a relative to your bedside, second medical opinions, bringing your body home in case of death, etc. – which are very useful if there is a serious incident.

Remember that neither your embassy nor your consulate is responsible for your repatriation or your healthcare expenses in case of a local medical emergency.

This covers all material and immaterial damages that an expatriate or a member of their family could cause to a third party.

Civil liability will not apply when driving a motor vehicle; please inquire with your car insurance company for this coverage.

Although basic coverage is provided locally, it is still minimal, and you should take matters into your own hands to protect your spouse and children.

It’s recommended that you purchase private insurance or one of the CFE options to be covered.